Shopify Payments – No More Fumbling with Payment Gateways

Our independent research projects and impartial reviews are funded in part by affiliate commissions, at no extra cost to our readers. Learn more

What is Shopify Payments, and is it worth your while?

Shopify Payments is Shopify’s built-in payment processor, meaning it eliminates the need for a third-party payment solution. You can still use third-party processors like PayPal and Stripe on your Shopify site, but Shopify Payments gives you the option to bypass all of the different account activations and dashboards that come with those other processors.

Shopify Payments is convenient for customers, too – you can enable local currencies and tons of popular payment methods, from credit cards to Apple Pay. The convenience of Shopify Payments is one of the reasons why Shopify is one of our top-rated ecommerce website builders.

But how does Shopify Payments really compare to veterans like PayPal? We’ll cover all of the finer details below to help you decide if this is the right payment processor for your site. First, a quick overview:

| Shopify Payments Pros | Shopify Payments Cons |

|---|---|

| No commission fees (Shopify takes up to 2% commission when you use other payment processors) | Unavailable in some countries |

| Sign up is quick and easy | Chargeback fees are only waived if the dispute is resolved in your favor |

| You can see all of your payout information in your Shopify admin | Some businesses are restricted depending on what products you sell |

Want to know more about Shopify before we start?

- Shopify Review – Our in-depth look at this website builder.

- Shopify vs Shopify Plus – Find out if your store will need the more advanced plan.

How Much Does Shopify Payments Cost?

Shopify Payments Pricing Overview

The only cost associated with Shopify Payments is a transaction fee that differs slightly depending on which Shopify plan you use to build your site. The highest fee is 2.9% + 30¢ per transaction on the Shopify Basic plan. It’s a pretty average rate with no extra fees.

Typically, when you sign up for Shopify’s cheapest plan, you’ll have to pay 2% commission on each sale, and even the priciest plan still charges 0.5% commission. When you use Shopify Payments, those commission fees are waived – even if your customers choose a different payment processor at checkout. Just by making the Shopify Payments method an option, you’ll be saving money.

So, to sum up, you’ll still have to pay a transaction fee, but Shopify won’t impose any commissions on top of the transaction fees the way it would with PayPal, Stripe, and other third-party processors – unless you live in Sweden, Austria, or Belgium, in which case additional costs apply.

As we mentioned, transaction fees are slightly different depending on which paid Shopify plan you use:

| Plan | Shopify Basic ($29/month) | Shopify ($79/month) | Advanced Shopify ($299/month) |

|---|---|---|---|

| Shopify Payments online transaction fees | 2.9% + 30¢ per transaction | 2.6% + 30¢ per transaction | 2.4% + 30¢ per transaction |

| Shopify Payments in-person transaction fees | 2.7% + 0¢ per transaction | 2.5% + 0¢ per transaction | 2.4% + 0¢ per transaction |

Is Shopify Payments Good Value For Money?

Yes. Most payment processors charge transaction fees of around 2-4% the value of each purchase, so Shopify Payments is pretty standard in terms of price. What makes it great value is that there are no extra commissions or hidden fees to complicate things or hike up the price.

Shopify Payments also rounds up prices when converting to different currencies, so you won’t end up losing funds if you sell to overseas customers.

Shopify Payments vs Competitors

You don’t have to use Shopify Payments just because you run your online store through Shopify. In fact, Shopify integrates with over 100 other payment processors, including giants like PayPal and Stripe. So, what are the benefits and drawbacks of each payment processor?

We’ve compared Shopify Payments with its most popular alternatives below, using the highest transaction fee that each processor imposes:

| Processor | Fees (US) | Fees (International) | Selling in multiple currencies? | Discounts for nonprofits? | POS* payments supported? |

|---|---|---|---|---|---|

| Shopify Payments | 2.9% + 30¢ per transaction | +1.5-2%, depending on store location | ✔ | ✘ | ✔ |

| PayPal | 2.9% + 30¢ per transaction | 4.4% + fixed fee based on currency | ✔ | ✔ | ✘ |

| Stripe | 2.9% + 30¢ per transaction | +1% | ✔ | ✔ | ✔ |

The biggest benefits of Shopify Payments happen on your end as the seller. Shopify Payments beats the competition because…

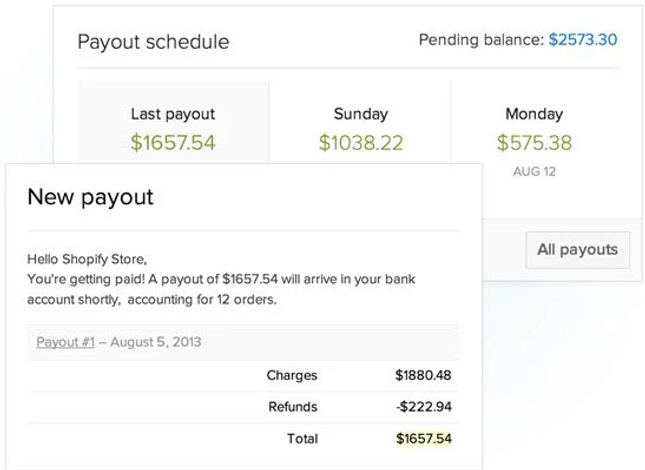

1. You Can Track Your Money In Real Time

You can track your sales and revenue with any payment processor, but Shopify Payments displays it all directly in your Shopify dashboard – so no more remembering multiple passwords and clicking around unfamiliar third-party websites just to access your financial info.

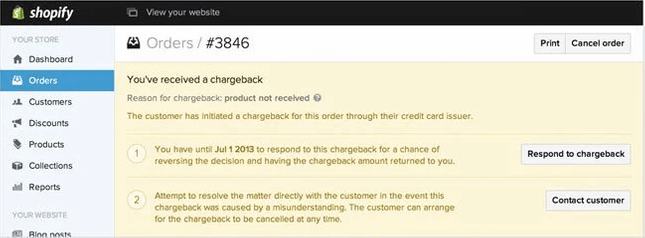

2. You’ll Have Support For Chargeback Recoveries

As a merchant, chargebacks are pretty much an accepted risk that you’ll have to deal with from time to time (they happen when someone makes a purchase from you, then files a complaint with their credit card company to try to cancel the transaction).

Processors like PayPal often take the buyer’s side in chargeback disputes, and you’ll have to provide additional proof about the transaction if you want help. But Shopify Payments offers more support, and you can respond to chargebacks directly from your Shopify dashboard. Shopify will even provide custom-generated responses for each order, using shipping and customer details from the transaction.

That said, it’s important to note when a customer’s bank sends you a chargeback, they also charge you a processing fee that varies by country – it’s a standard charge of $15 in the US, for example. Shopify will only pay this fee for you if the chargeback is resolved in your favor. If the chargeback is resolved in the customer’s favor, or if you choose not to dispute it, then you’ll have to pay the $15 yourself.

3. Your Customers Won’t Be Redirected At Checkout

Adding any more steps than necessary to your checkout process can be bad for conversion rates. In 2021, 18% of US online shoppers have abandoned an order purely because the checkout process was too long or complicated. The advantage of Shopify Payments is that it simplifies the checkout process for customers, rather than adding even more steps.

What About the Weaknesses?

It’s safe to say that Shopify Payments has its fair share of advantages. But processors like PayPal and Stripe are also popular for a reason, and they do manage to top Shopify Payments in some areas.

Stripe offers even stronger chargeback protection than Shopify Payments. If you’re willing to pay an additional 0.4% per transaction, then Stripe will cover any disputed amount of money and waive any dispute fees – with no evidence submission required on your part!

To qualify for PayPal’s Seller Protection, on the other hand, the goods you sell must be tangible – which means that services and digital goods aren’t covered. You’ll also have to provide a lot of documentation about the disputed purchase, which can be a time-consuming process.

PayPal’s greatest strength is its popularity – in 2020, 71% of ecommerce merchants offered a PayPal buy button on their website, meaning it’s a brand that customers know and trust. But that’s what’s so great about Shopify Payments – you can reap the benefits listed above, and offer PayPal as an additional option.

What Are the Limitations?

Currently, Shopify Payments is only available in certain countries, including:

- United States

- Canada

- United Kingdom

- Singapore

- Australia

- Ireland

If Shopify Payments isn’t available in your country, then you can still choose from the many other payment gateways that Shopify supports.

Shopify also prohibits certain types of businesses from using Shopify Payments. The list differs slightly depending on what country you’re in – for example, the following types of businesses cannot use Shopify Payments in the US:

- Investment and credit services, including securities brokers, mortgage consulting services, and real estate opportunities

- Money and legal services, including check cashing, wire transfers, currency exchanges, and bail bonds

- Virtual currency, including Bitcoin, digital wallets, and cryptocurrency mining equipment

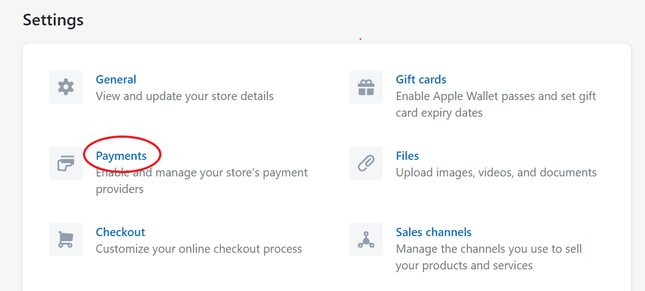

How Do I Set Up Shopify Payments?

Once you have a Shopify account, you can click on the “Settings” tab in the lower left-hand corner of your dashboard, and then click on “Payments.”

From there, you’ll just have to provide some basic info about your business, starting with the business type. You’ll be able to classify your business as one of the following:

- Individual/sole proprietor/single-member LLC

- Corporation

- LLC

- Partnership

- Nonprofit

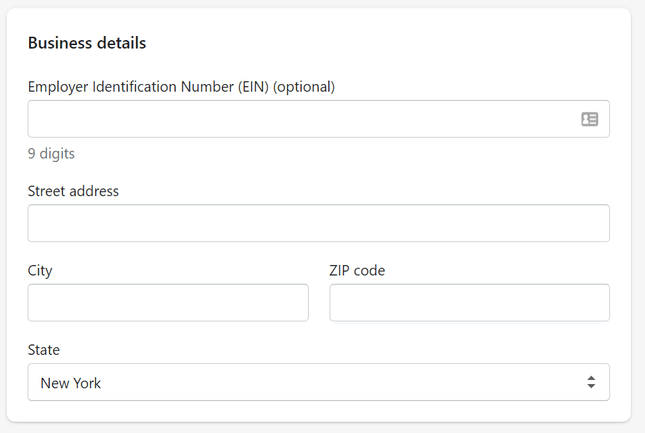

Then, you’ll want to provide your Employer Identification Number (if in the US) and business address.

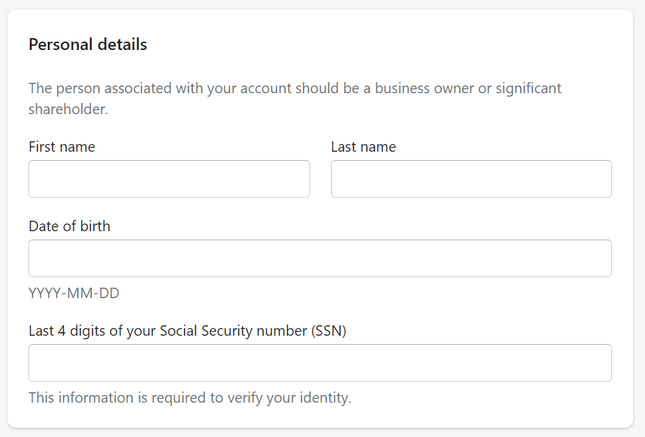

Next up are your personal details:

Next you’ll be asked to add in a short description of the products or services your business provides, and to include your name and phone number the way you’d like them to appear on customers’ bank statements.

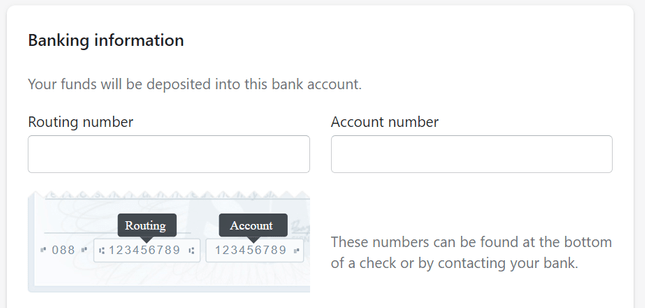

In the final step, you’ll provide your banking information…

…And voilà, you’re ready to start accepting payments!

Integration With Shopify POS

A point of sale (POS) system is technology that processes payment transactions at the point of purchase. In other words, you can manage both offline and online sales all in the same place.

Shopify offers its own POS system in the form of an iPad app that lets merchants make sales in-store. As you can imagine, it’s not the most in-demand item of 2021, but it’s a great tool that you can even sync with your digital Shopify store to track all of your clients’ orders in one place.

Shopify offering its own POS system, which integrates easily with Shopify Payments, means it’s never been easier to accept and track payments both in-store and online. Shopify is ahead of the competition here – PayPal, for example, doesn’t have its own POS system, so you’d have to employ another third-party to sell in-person.

Shopify’s in-person transaction fees range from 2.4-2.7% of the sale price, depending on which Shopify plan you use for your website. You can install the Shopify POS app on your iPhone, iPad, or Android, and login with your Shopify account details. Your digital Shopify store will automatically synchronize with Shopify POS.

Shopify Payments Review: Summary

In short, Shopify Payments is a convenient tool for both you and your customers. You’ll get to manage all of your revenue from your Shopify dashboard, and your customers won’t have to slog through third-party checkout processes.

As with any payment processing tool, we recommend you read the full terms of service before making a final decision. But if you value easy setup, straightforward management, and POS integration, then Shopify Payments won’t disappoint.

FAQs

Yes. Businesses in the US, for example, can accept Visa, Mastercard, American Express, JCB, Discover, and Diners Club debit and credit cards.

If your customer raises a chargeback dispute but then decides that it was a mistake, it’s possible to reverse the chargeback – but only the customer can do so via their bank.

Refunds take approximately 5-10 business days. Shopify will submit the refund to your customer’s bank immediately, but the bank must then process the refund and apply it to the customer’s account, which is why the timing varies.

Shopify Payments is as secure as Shopify’s website building platform – so in other words, very secure. Every Shopify store is PCI compliant by default, which means your customers’ payment card information is protected and networks are regularly monitored to prevent any breaches.

65 comments