Top 6 Small Business Challenges and How to Overcome Them

Our independent research projects and impartial reviews are funded in part by affiliate commissions, at no extra cost to our readers. Learn more

Choosing a website builder for small businesses, late nights, and constant funding rejections – these are all challenges of operating an ecommerce business. We know how much effort goes into creating your own business.

After all, we’ve been helping people like you set up a successful business online for 10 years. So you can feel confident we understand all about the challenges faced by small businesses.

To be fully prepared, you need to be one step ahead of the game. This means identifying the greatest challenges of small business growth and feeling confident you can overcome them when they inevitably arise.

This article will help you comprehend how to tackle six of the most common small business challenges today, so without further ado, let’s get started.

Why Overcoming Business Challenges Matter

Within the first two years, roughly 20% of US businesses fail according to the U.S. Bureau of Labor Statistics. Although this number isn’t as staggering as the often-cited 90% figure in the UK, it is still one-fifth of new businesses that won’t make it to their second birthday.

You can guarantee that the reason 20% of companies fail will typically coincide with one (if not multiple) of the small business challenges highlighted in this article.

What you need to do to ensure you don’t become a member of the “20% club” is to plan ahead. Forward-thinking is the key to managing and overcoming these business challenges.

So, what are they? Let’s take a look…

Top Small Business Challenges

#1. Finding Customers

You can create a revolutionary product that will solve a huge problem (no, not like the spork), but if you don’t have the customers, your business will struggle to survive.

The issue isn’t around a lack of consumers, but with the sheer number of businesses competing against each other. There are currently 1.5 million online retailers selling their products and services in the U.S. via their own website or marketplace.

Every brand is actively trying to attract customers and increase sales. Many industries are competing to find customers in an oversaturated and fiercely competitive market. It’s a common problem for businesses, and one of the top challenges for ecommerce stores.

As a result, small businesses are struggling to stand out from the crowd. They lose out to rival brands and can’t maintain sales, but your business can avoid the same fate by following these steps.

Invest Time in an Effective Marketing Strategy

Hire an accomplished marketer, and invest time and money into marketing your brand by:

- Utilising the power of social media – run competitions and giveaways on popular social platforms like Instagram and TikTok. Post engaging, creative content that will stop those thumbs scrolling!

- Building a buyer persona – before you spend money on marketing you need to understand exactly who your target customer is. Spend time creating a thoroughly detailed user persona of your ideal buyer, and then use this to help determine your marketing strategy.

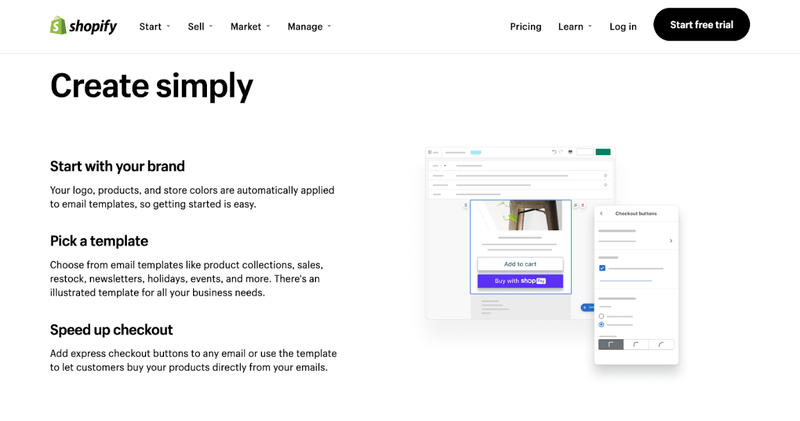

Ecommerce platform Shopify offers effective customer outreach tools. Features include email marketing, abandoned shopping cart notifications, and CRM software integrations to help move customers down the sales funnel.

Find Out More

- To find out more about using email marketing to find customers, check out our lead magnet ideas article.

- We interviewed The Wrinkly Elephant, a small business specializing in natural soap, to hear about their highs and lows

#2. Getting Invoices Paid

Worldwide, 54% of SMEs expect invoices to be paid late. While in 33% of cases, invoices are shockingly taking longer than a month to be processed.

It is a worrying problem that has caused SMEs in the US to lose over half of the value of their B2B payments.

Small business invoices are frequently paid late because:

- Accounting departments may operate manually, increasing the risk of errors. Incorrect invoices account for 61% of all late payments according to software company Amalto.

- Lack of strict invoice terms and conditions. Businesses may not add strict payment date terms, or penalty conditions for late payments.

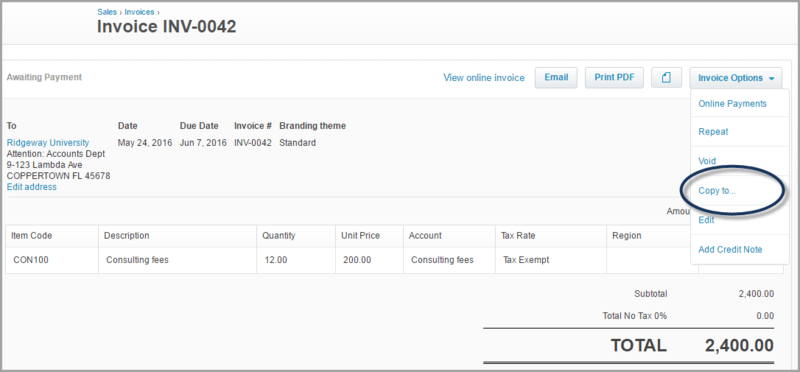

Your business should never handle invoices manually. Instead, you should use invoicing software. QuickBooks and Xero are two of the most popular and affordable options for small businesses.

By using invoicing software, you can:

- Avoid incorrect invoices caused by human error, with a guaranteed accuracy rate of 99% with most software.

- Save time with automation, so your team can focus on other tasks.

- Interpret data quickly and efficiently. Allowing you to determine which clients are paying on time, and which aren’t.

Advice from the Experts

Top tip! Another way to ensure invoices are paid on time is to offer a service/product discount to clients that pay within a specified number of days.

#3. Finding Talent To Hire

Hiring employees isn’t getting any easier according to a 2022 survey by CNBC, which revealed that over 50% of small business owners in the US found it harder to hire in the third quarter of 2022 compared to 2021.

Part of the issue is inflation, which has seen wages increase across the board.

So how can you find the right talent without breaking the bank? Action the following steps and you’ll be inundated with applicants in no time!

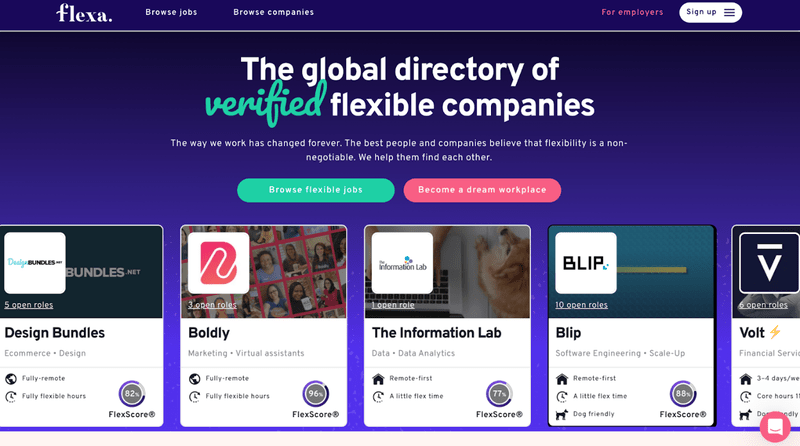

- Become “flexible working” verified – job seekers are looking for genuinely flexible working environments that meet their expectations. Becoming verified by a flexible working directory like Flexa gives you access to a pool of talent previously unattainable.

- Offer referral incentives to current staff – incentives will encourage your employees to reach out to friends or family that would be an ideal fit for your business.

- Have clear and visible company values and goals – employees and employers need to share similar values and goals. Ensure these are easily accessible to job seekers.

#4. Eradicating Dependence on Individuals

Picture this. One particular employee manages all marketing and accounting tasks. They suddenly go off sick long-term and your other employees have no idea what to do, or how to help. You’re stressed because you now need to juggle running the business as well as managing those other elements of the business.

Sound familiar? That’s because it happens far too often when small businesses are concerned.

As such, it isn’t uncommon for employees to have a hand in several different roles at a small business. Particularly since overheads need to be managed carefully and the average cost of hiring an employee in the US is $4,000. Unfortunately, when someone falls ill or leaves the company, this can leave you short on the ground.

But don’t panic – you can overcome this challenge by taking the following steps.

Hire Interns

By hiring an intern within each department, you’re providing additional manpower and cover if you should ever need it. Interns are typically enthusiastic and eager to learn, as well as grateful for an opportunity to gain valuable work experience.

Outsourcing

Outsourcing is considerably more expensive than hiring an intern, but it brings to the table droves of experience and expertise. It’s a reliable way to ensure one employee isn’t managing too many elements of your business. And it’s a great way to train members of your team in-house, as they can shadow and learn from the outsourced employee.

#5. Maintaining Quality While Growing

In many small business cases, product/service demand increases at such a rate that the business cannot cope. As a result, many are forced to cut corners on quality checks, for example, to keep up with supplier demand and contractual obligations.

Other businesses find themselves running out of cash as they await payments from large orders. When cash flow is running low, companies must borrow, or sacrifice the quality of their products/services (by using cheaper materials for example).

This is not the way to scale and is often detrimental to a growing business. Customers, particularly returning customers, will notice a drop in quality and take their money elsewhere.

This is why maintaining quality is so important as your business grows. Let’s go over how you can do this.

Ensure You Have a Healthy, Solid Cash Flow

It is imperative you have enough funds for your business to run at an optimal level, especially as you scale. Check your accounts and plan accordingly for an increase in outgoings.

Adopt a Product Quality Management (PQM) Strategy

If you haven’t already, you should ensure you have a solid PQM strategy in place. This ensures that any product you manufacture or sell has gone through a rigorous quality assurance process, to make sure it is of the highest standard.

There are a number of PQM methods businesses can use to create a PQM strategy. But as you scale it is imperative your business has one in place. One damaging review from an unhappy customer can do a lot of harm to your growing venture.

#6. Testing Product/Service Ideas

According to the Harvard Business School, of the 30,000 new consumer products launched each year, a staggering 95% of them fail.

Many small businesses focus their efforts on designing a product their target market will be interested in, without testing it further. However, this is not enough to guarantee sales, as you can never confidently predict exactly what a certain demographic of people wants.

So, how best can you test a product or service before you go live? Check out the list below.

- Conduct research on social media – an effective way to gauge how well a new product will perform is to ask your followers. A simple poll will suffice, or a pre-launch competition to analyze how much hype it generates.

- Create a pre-launch landing page – by building a website landing page for your product/service, you can analyze the traffic/visitor data to help determine how successful your product may be. To find out how to do this, visit our article on testing a business idea.

- Sell your product at market stalls and pop-up stores – you can gauge consumer interest by calculating how many sales you make at these events, or how many people sign up to receive your product once it launches.

Summary

With so many new businesses failing within the first few years, you need to be sure you’re one step ahead of the game.

Use this article to put together an action plan that will help you overcome the small business challenges we have touched on, and you will be able to weather the storm that is owning a business.

And remember, don’t underestimate the importance of marketing!

Leave a comment