Ecommerce Valuation: How Much Is Your Ecommerce Business Worth?

Our independent research projects and impartial reviews are funded in part by affiliate commissions, at no extra cost to our readers. Learn more

If there’s one thing as priceless as a profitable, well-managed ecommerce business, it’s an exit strategy. Being able to pack up, sell up, and stroll off into the sunset – and getting a pretty penny for your business in the process?

That sounds pretty good to us!

But before you sell up, you’ll need to know exactly how much your business is worth – something that’s easier said than done. All businesses are unique, after all, and differ in size, style, and setup – not to mention the stock they sell.

Here at Website Builder Expert, we understand ecommerce businesses better than most. We know exactly how difficult it can be to get to grips with how much your online business is worth – and we’re here to help.

Below, we’ve summarized the most popular methods of valuing your ecommerce business, as well as some of the key valuation drivers involved.

So read on to find out how you can effectively, efficiently value your ecommerce business – and maximize its allure to potential buyers.

How to Value Your Ecommerce Business: Key Methods

- SDE Multiple Method of Valuation Jump to section

- EBITDA Multiple Method of Valuation Jump to section

- Revenue Multiple Method of Valuation Jump to section

- Discounted Cash Flow Analysis Jump to section

- Precedent Sales Jump to section

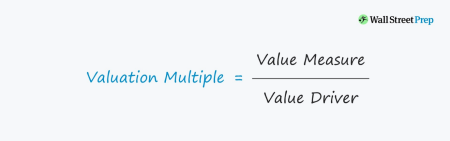

The most effective way of valuing your ecommerce business is to use valuation multipliers. These are like ratios, which – as we know – are ways of comparing two things with each other. Valuation multipliers, then, reflect how much your company is worth in relation to one or more financial metrics.

The value measure here is the value of your business – so, the exact thing you’re trying to figure out. Value driver is a financial or operating metric – this could be revenue, SDE, or EBITDA, or factors such as your brand recognition, traffic, scalability, or customer retention.

So, to calculate the value measure, you need to multiply the value driver by the multiple. But how do you get these figures?

Well, going to a valuation expert is the most accurate way of obtaining the right value multiplier. This figure will be based on similar ecommerce businesses, and take into account current market conditions.

Alternatively, you can download an industry report or business reference guide to get an idea of your business’ value multiplier. This data will cost you, but nowhere near as much as springing for a professional valuation consultant. Considering your business’ valuation drivers is also helpful when it comes to figuring out your company’s unique value multiple – we’ll get into more detail about these later on.

For the value drivers – unique elements that relate to your business, such as customer base, brand awareness, and business growth – you can speak to your accountant or your marketing team – or dive into your business’ books yourself.

We’ve broken down each of the key multiple methods of ecommerce valuation below.

SDE Multiple Method of Valuation

The SDE (Seller’s Discretionary Earnings) is a metric you can use to figure out your business’ historical cash flow. It contrasts a business’ discretionary earnings – its total takings, including taxes, interest, depreciation, and other adjustments – with the company’s implied value (the multiplier). Last year, the average range of value for SDE multiples was between 2.0x and 4.0x.

Let’s say, for example, that your business has $100,000 in SDE, and transacts at a 3.0x SDE multiple. Your company’s implied value would be $300,000.

EBITDA Multiple Method of Valuation

EBITDA stands for Earnings Before Interests and Depreciation and Amortization. It’s the most accurate measure of a company’s overall financial success and profitability.

How Can I Calculate My Business’ EBITDA?

There are two formulas you can use to calculate your business’ EBITDA. The first relies on your operating income – your profit, minus your operating expenses.

Operating Income + Depreciation & Amortization

The second formula relies on your net income, and goes as follows:

Net Income + Taxes + Interest Expense + Depreciation & Amortization

Once you know your business’ EBITDA, you can then multiply it by the relevant value multiple. Again, this is best provided by a valuation expert, but – if previous data averages are to be believed – will most likely fall between 3.0x and 6.0x.

If your ecommerce business, for instance, has an EBITDA of $400,000, and transacts at a 6.0x multiple, your company’s implied value would be $2.4 million.

Revenue Multiple Method of Valuation

Like the above modes of ecommerce valuation, the revenue multiple method relies on knowing your value multiplier.

This will depend on your business’ specific size and situation, as well as the type of ecommerce business it is. There’s no hard and fast rule for revenue valuation multiples, but – according to data from Peak Business Valuation – you can expect it to be between 0.3x and 0.5x.

Then, the calculation is as simple as multiplying that multiplier with your ecommerce business’ total sales or revenue.

If you made $500,000 in sales over the course of the financial year – and your business transacts at a multiple of 0.5x – the company has a projected value of $250,000.

Discounted Cash Flow Analysis

While figures like SDE look to the past – at how much your business has already made, and extrapolating from there – a discounted cash flow (DCF) analysis looks ahead.

A DCF analysis attempts to calculate what a company will be worth in the future – in other words, at how long it’ll take for that business to reap ROI for the buyer.

Precedent Sales

The precedent sales model of valuation looks at how much businesses are worth in similar markets – and what they’re already selling for. These might be companies of a comparable size, time in business, and yearly revenue to your own.

Valuation Drivers For an Ecommerce Business

- Financials Jump to section

- Revenue Concentration Jump to section

- Customer Base and Retention Jump to section

- Brand Recognition Jump to section

- Traffic (and Traffic Quality) Jump to section

- Growth Jump to section

- Trends and Market Outlook Jump to section

- Business Age Jump to section

- Operations and Operating Costs Jump to section

- Scalability Jump to section

So, now you have the tools with which to calculate your ecommerce business’ value. But the job doesn’t end there. If you’re thinking about selling your business, you’ll also need to consider how to maximize its appeal to investors.

That means looking at your business’ key valuation drivers – those factors that set your business apart from all the others on the market.

Plus, having a good knowledge of your ecommerce business’ valuation drivers isn’t just handy for making it an attractive proposition for buyers. It can also help you figure out your valuation multiple. The more valuation drivers, the higher the multiple – meaning the more your business is worth.

Here are several quickfire valuation drivers to consider:

Financials

The big one. When it comes to valuing an ecommerce business, the better your financials – healthy sales, impressive profits, expensive assets, encouraging projections – the more you’ll be able to sell it for.

Revenue Concentration

This metric refers to how much of your total revenue comes from your highest paying client (or a set of them).

It is, of course, fantastic to have big customers – loyal clients, that do business with you again and again. But ideally, you don’t want too many of your profits coming from a small amount of your patrons. It’s considered a risk by valuation experts (particularly if one or more of those clients were to stop buying from you), so may drive the market rate of your ecommerce business down.

Customer Base and Retention

When assessing your company, valuators will look at both the size and loyalty of your customer base. How many customers do you have – and how good is your business at retaining them?

Brand Recognition

McDonald’s is worth a lot more than independent Melbourne-based burger joint Easey’s, for example. Are McDonald’s’ burgers any better? Nope – but its brand is.

That’s why any valuation of your ecommerce business will take into account how well-known your brand is. Is it easily recognizable by customers? Do people associate your brand with positive sentiments, have they bought from it, and – better still – would they buy from it again?

Market research can help you determine how recognizable your brand is.

Traffic (and Traffic Quality)

Traffic isn’t everything (conversions are important, too!) but – for online businesses, at least – it’s half the battle.

Potential buyers, of course, know this – so they’ll be interested in how much traffic your website is generating on a daily basis. They’ll also be keen to assess the quality of that traffic – whether people are finding their way to your site by accident, or actually having meaningful interactions with it when they’re there.

Growth

This valuation driver is as simple as it is important – is your ecommerce business growing? To measure this, you can look at factors like:

- Conversion rate

- Social media engagement

- Bounce rate

- Cart abandonment rate

- Customer acquisition cost (CAC)

- Customer lifetime value (CLV)

- Average order value (AOV)

- Customer retention rate

- Backlinks (and the quality of those backlinks)

The more your business is growing, the more appealing it’ll be to investors!

Trends and Market Outlook

Your business doesn’t exist in a vacuum. It’s both a product of – and a response to – an intricate, interconnected web of forces known as a market. And a changing one, at that.

Wider market trends, then – and the overall outlook of the space your business operates in – will be influential in deciding how much it goes for.

Business Age

As a general rule, the longer your ecommerce company has been around, the more appealing it’ll be to buyers. With time in business, you’ve demonstrated not only a healthy market need for your services, but also your ability to provide (and keep on providing!) them, too.

Operations and Operating Costs

To run an ecommerce business, it costs money. There’s web hosting for one, and the cost of your ecommerce website builder, if you use one. Throw in the money required to pay staff, buy inventory, and handle fulfillment, and it all starts to add up!

The more you can cut these operating costs down, then – or at least demonstrate to a valuator that they’re as low and well-managed as possible – the more your business will be worth.

Scalability

Again, the value of your ecommerce business doesn’t just come down to what it is now, but what it could be in the future.

So is your business scalable? Do the processes, people, and wider market infrastructure exist for it to grow – strategically? The more scalable your business is – the more opportunities it presents – the more it’ll be worth to a buyer.

How Much is Your Ecommerce Business Worth? Summary

If there’s anything more challenging than starting an online business, it’s selling one – especially when the process of ecommerce valuation can be so tough.

But with a knowledge of valuation multiples under your belt – and how to use them to value your business based on EBITDA, revenue, and SDE – you have everything you need to get the best deal for your business. To price up, pack up, sell up, and shift your focus to the next exciting opportunity.

So what’s next? Well, you can start by figuring out what exactly that opportunity is, with our guide to 12 online business ideas. Or, you can browse our site for industry-leading research and market statistics, ratings, and reviews of the best website builders on the market – and beyond!

Leave a comment